The Relationship Between Short Duration Bonds Versus Value Stocks

And Why Value Stocks Are Outperforming Growth Stocks

I love it when investors discuss bond math because you truly get a view of why markets behave the way they do in a clear and concise model. The running joke is if you want to understand the stock market don’t talk to an equity analyst speak to a bond analyst. This is because if understood correctly bond valuation connects risk, growth, time, even psychology all into one model. Let me explain.

Talk of increasing interest rates by central banks around the world have spurred a debate between growth and value stocks. Below are YTD daily returns (January through March 2022) from the Ken French data library breaking down the equity universe between the highest book-to-market stocks (HiBM proxy for value) and lowest book-to-market stocks (LoBM proxy for not value or growth). As you can see money has poured out of growth stocks into value stocks.

Something more investable and familiar are the YTD returns of both the Vanguard Large Value and Small Value ETFs (VTV and VBR) versus the Vanguard Large Growth and Small Growth ETFs (VUG and VBK). Again we see the same outperformance of value over growth. One dollar invested in VUG or VBK would be worth $0.89 and $0.88 cents respectively, while $1.00 invested in VTV or VBR would be worth $1.00 and $0.98 cents respectively.

But why have value stocks done so relatively well in this environment? The answer may be explained by a simple bond statistic called duration.

Quite simply duration measures the change in a bonds price for a given change in interest rates. A short or low duration bond implies bond prices will move very little to changes in interest rates, while the price of a long or high duration bond will move a lot with changes to interest rates. Why is this useful? If we predict interest rates will increase a greater than expected amount we should allocate funds toward lower duration bonds, therefore reducing our losses. On the other hand if we believe interest rates will fall we can position ourselves to make relatively more money by allocating funds towards higher duration bonds.

We can apply this same model to stocks. Short duration stocks include low Price-to-Earning (P/E) and Price-to-Book (P/B) multiples. These are collectively known as value stocks. Many of the companies in this basket already produce earnings. Longer duration stocks include high P/E and P/B multiples. Usually high multiple firms will have no earnings, but very large historical revenue growth. Thus the word growth stock best describes this basket of companies. Why are potential increases in interest rates effecting growth stocks but not value stocks? To understand why, we need to break out the bond math.

The value of a bond is equal to its discounted future coupon or cashflow (CF) and final principal payment (CFn). We can see several relationships between interest rates (r), coupon payments and the bonds value (PV).

First you will notice an inverse relationship between the bonds price (PV) and interest rates (r). What do I mean by this? As rates go up the current value of the bond falls down, as rates go down the value of the bond goes up.

Secondly a positive relationship between the bonds price and the future coupon payments (CF). This means the greater the value of the future coupon the greater the value of the bond price, the smaller the value of the future coupon the smaller the value of the bond price.

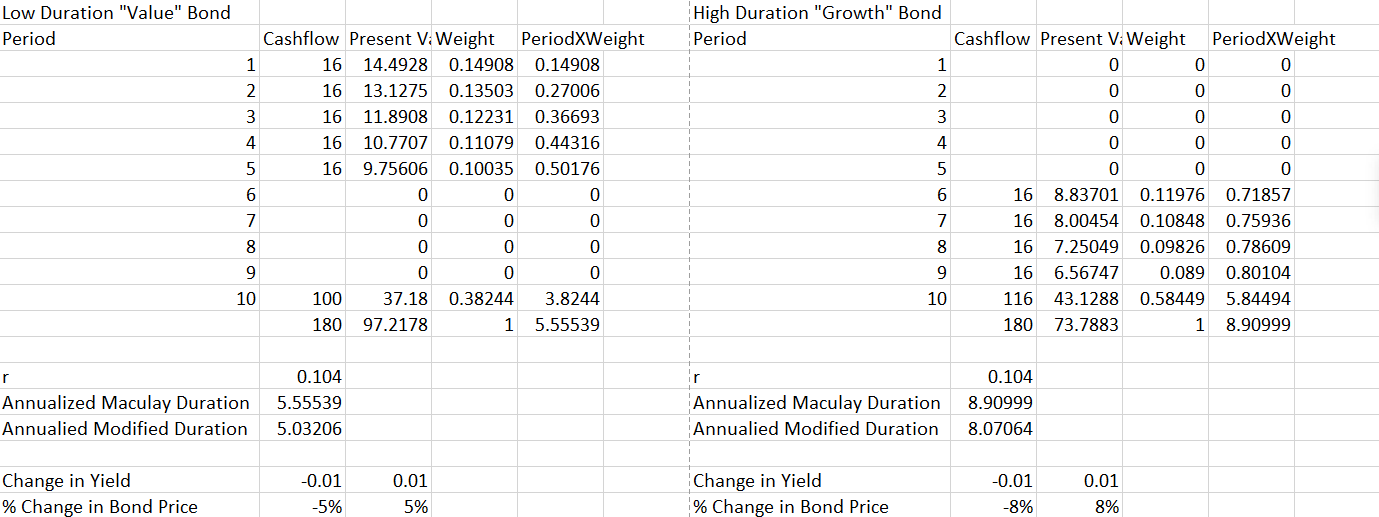

The third relationship is harder to see, but has to do with the timing of coupon payments. Lets compare two bonds. One with coupon payments paid out earlier in the bonds timeline and one paid out later in the bonds timeline. Both bonds pay the same value of coupons, but one pays it earlier as opposed to later. Now lets change interest rates up and down.

Notice how the price of the bond that pays the coupons earlier in its lifetime (“Value” Bond) is less sensitive to changes in a 1% (0.01) move in interest rates than the bond that pays the coupon later in its lifetime (“Growth” Bond). This is the same bond duration math we hear investors talk about when explaining the changes in value and growth stocks. A value stock behaves similarly to a lower duration bond since a larger portion of its earnings or dividends are paid out earlier in the expected timeline as opposed to a growth stock such as an internet or bio technology company, earnings are paid out much later in the timeline, just like a high duration bond.

If markets continue to surprise investors with increasing interest rates around the world we should expect lower duration companies such as value stocks to outperform their growth stock counterparts. I currently have a large weighting towards the following value oriented exchange traded funds: AVUV, AVDV, AVES and QVAL. Happy investing!